Mace has predicted 600,000 current construction roles will disappear by 2040. The firm’s innovation director Matt Gough talks to Will Mann about the radical reskilling that lies ahead.

With a forecast that up to 600,000 current roles will disappear by 2040, Mace provided a startling vision of construction’s future in its report, Moving to Industry 4.0, launched at the end of last year.

Should the industry’s workforce be apprehensive? Mace’s director of innovation Matt Gough, charged with “aligning” the company’s technological transformation, thinks not.

“It is an opportunity,” he argues. “The past few weeks have been really significant for the industry, with the government recognising construction as one of four key sectors in its industrial strategy. We can catapult ourselves into a different space – if we seize the opportunities offered by emerging technologies and reskill the industry.”

So which jobs will be affected first by construction 4.0, and how will the industry’s workforce need to adapt to survive?

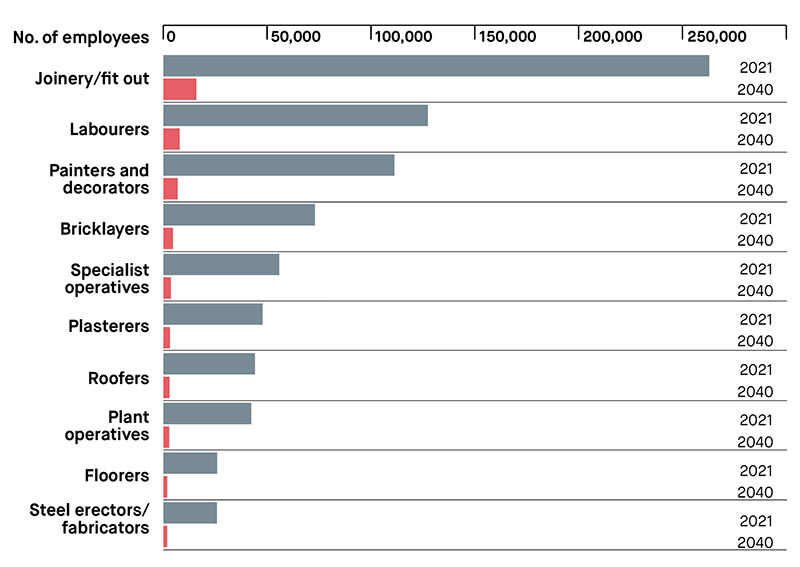

Mace has identified 10 trades in its report – based on CITB statistics, Oxford University research on the impact of automation, and economic forecasting from the Westminster Policy Institute – which will be most affected (see chart). Joinery, painting and decorating, and bricklaying will all see over 94% of current roles disappear.

“We are already seeing some traction in certain areas, with development of brick-laying robots,” Gough notes.

How quickly those roles disappear depends on how quickly construction embraces the new technology. This may not come naturally for an industry that “hasn’t always been good at innovating”, acknowledges Gough, whose own background includes a degree in film studies and IT, and a spell in the music industry.

“We were slow to catch on with industry 3.0, the digital revolution, and you could say construction didn’t really spot 2.0, which was mass manufacturing,” he observes.

Construction employment change 2021-40: top 10 trades affected

Source: Mace (figures based on fast-paced technological change).

But with 4.0 – which includes robotics, artificial intelligence and the internet of things – Gough says the industry’s advantage is that “it isn’t hampered by old technology, because construction companies don’t own many assets, unlike manufacturing for instance, so they can be agile and flexible”.

Mace has identified seven priority areas where Gough believes “industry 4.0 technology” can have a significant positive impact.

Drones is one. “Already we are using drones to survey large sites at a pace you wouldn’t have been able to previously, and inspect areas of buildings that are really hard to get to, for example, tall building facades,” says Gough.

Other priority areas include use of augmented and virtual reality, big data and analytics.

“Smart building technology is becoming more commonplace,” says Gough. “Our FM business is using sensors regularly now to monitor building operation, utilisation and energy performance. The FM and property space is a market ripe for disruption using 6D BIM and smart construction technology.”

Mace’s technological ambitions are helped by the firm being privately owned and “pretty agile”, acknowledges Gough. “When we’ve wanted to create new services or move into new sectors, we’ve been able to do it pretty quickly. ”

But the wider industry is also changing, he stresses. “Entrepreneurs are moving into construction; venture capital startup funding for construction technology worldwide grew from £70m in 2012 to £286m last year and is forecast to grow even more,” Gough says. “The government upped the R&D tax credit to 12% in the autumn statement, and also there is the £170m challenge fund for innovation in construction. Mace will be bidding for some of that.”

The next steps for Mace are to implement a skills strategy so it can exploit industry 4.0 technologies in its business. That is the plan for 2018, Gough says.

“The skills we need aren’t necessarily technical skills – we need to empower people to try new technology and understand how they might use it,” he explains. “We are not going to build a drone-flying business at Mace, but we will work with drone experts who can help us make drones part of what we do.”

Notably, Mace’s report doesn’t forecast how many white-collar roles will be affected though Gough says “we are already automating lots of processes in Mace”.

“People who used to spend a lot of time banging things into spreadsheets will now have their time freed up,” he says. “For example, there has been speculation that BIM will put estimators out of a job. We are predicting that data analytics will become very important for construction, and will see a growth in jobs – and who better than estimators, who are already used to number crunching, to lead the charge in that field?”

Project managers will need to understand how best to employ the new technology, says Gough: “Artificial intelligence will help with some aspects of project delivery, but somebody still has to ask the question in the first place.”

The report’s tagline is “a skills revolution”. While Mace may be preparing for the revolution, it will be interesting to see if the wider industry is.